High accuracy data extraction with AI-powered FastKYC.

Legal requirements often force financial institutions all over the world to abide by the Know Your Customer (KYC) norms laid down by the regulatory authorities in their respective countries. Governments generally use KYC standards to help stop crimes within their borders such as money laundering, fraudulent activities, and other financial crimes. In India, the Reserve Bank of India (RBI) is authorised to formulate the KYC norms. Indian financial institutions use the Permanent Account Number (PAN) card as a vital KYC document to verify the customer identity and ensure the tax regulations are followed. The PAN card comprises personal and financial information, including the name, date of birth, photograph, signature, and PAN number of the holder, which is used to verify the identity of an individual or the organization. The Aadhaar, a distinctive biometric identification card provided by the Indian government, is also usually linked to the PAN card.

Conventionally, PAN card data is processed manually by the officials of the financial institutions. The PAN card data is collected from the customer in a physical form, and the officials of the financial institutions verify the data with the physical PAN card. However, this process is tedious, less efficient, error-prone and causes time-delays.

You may also have a look at PredicTenor, our sentiment-analysis tool for tracking Twitter trends.

The strides in technological advancement have disrupted the conventional methods, processes, and thoughts related to KYC procedures in financial institutions. Artificial Intelligence has made almost anything possible, including the automation of many of these processes. One such application of AI is in the development of Intelligent Document Processing (IDP) systems, which could effectively reduce the workload on staff and minimise errors. To facilitate faster and precise processing of PAN card applications and related KYC tasks, the CogNext AI—ML team has developed a live app – FastKYC – which can extract information from PAN card images.

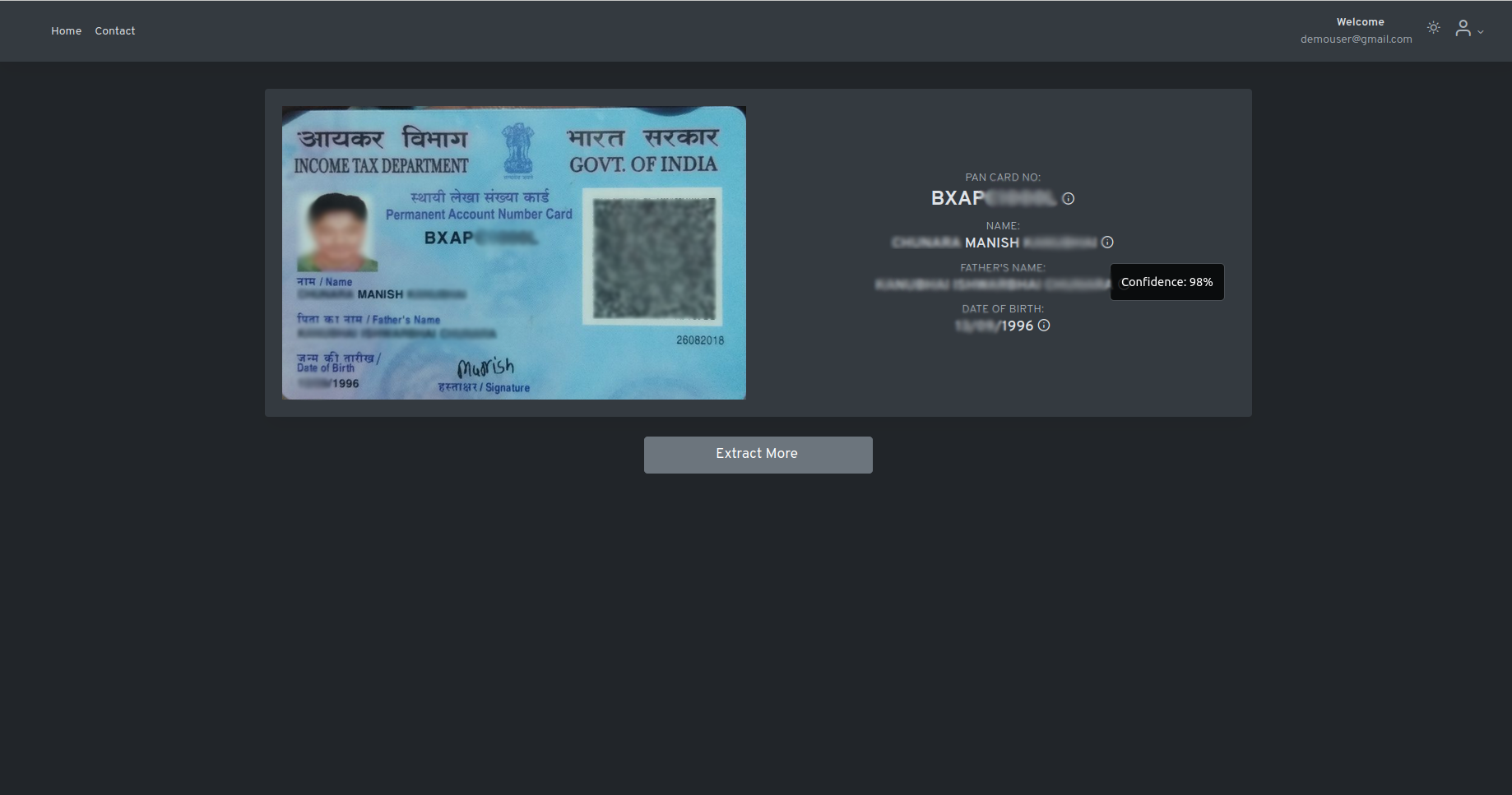

Figure 1: FastKYC has a simple and intuitive interface.

Figure 1: FastKYC has a simple and intuitive interface.

FastKYC is available as a REST API endpoint to which a POST request containing the PAN card image data maybe sent to retrieve the details. After processing the POST request, the API will return the extracted information and the estimation confidence in JSON format. The API is built using Python and FastAPI. It was chosen for its scalability, speed, and ability to asynchronously process multiple requests.

FastKYC allows the user to extract the relevant data from a PAN card image. The app can recognise information such as the cardholder’s PAN, name, father’s/husband’s name, and date of birth. The API requires just the base64 encoded image data of the PAN card. It can extract information independent of the new and old PAN card format. The AI-powered backend is also capable of correcting slight skewness, distortions, and rotation of the input image, before extracting the information.

A user-friendly interface is also provided to access the API. Users can simply upload or drag and drop the PAN card image to the front-end. After processing, the extracted information will be displayed in a structured format. There are also provisions to display the sentence-level extraction confidence. The API is fast and can asynchronously process multiple requests. This makes it the best solution for handling large amounts of PAN card digitisation or processing other related tasks. The automation of extracting the data from PAN cards can save a significant amount of time, especially for organisations that handle large volumes of PAN card verifications or need to process PAN card-related tasks regularly.

The app uses advanced deep learning algorithms to accurately recognise and extract data from PAN card images. This reduces the occurrence of errors that can happen with manual data entry. The app's fast and accurate data extraction capabilities can significantly increase efficiency in identification and verification processes. This application can be used for industries which provide financial services or government organisations that need to process huge amounts of transactions quickly.

While the app is built as a powerful tool to accurately and efficiently extract data from PAN cards, it does have some limitations. Even though, the API has tolerance for a level of distortions, skewness and rotation, the API may fail to accurately extract information from an illegible, poor quality image. Additionally, data extraction from organisational PAN cards would be made available only in the future versions. Support for other documents like Aadhaar card etc., other ID cards are in the pipeline.

Please reach out to us in case you need any further information: info@cognext.ai

You may also have a look at PredicTenor, our sentiment-analysis tool for tracking Twitter trends.