What is Platform X - Basel III/IV?

Platform X is a comprehensive regulatory reporting solution specifically designed for Banks targeting to implement a cost effective Basel Regulatory Capital Computation engine. It establishes an automated process for regulatory capital computations across Credit, Counterparty Credit, Market and Operational Risk and also provides regulatory reports prescribed by regulators.

Calculation

Rules

Credit Risk capital assessment with national discretion options covering local regulations in Europe, Asia, Middle East and Americas; Basel II/III and IV supported.

Also covers the common approaches for the Market Risk and Operational Risk capital assessment.

Configuration

Management

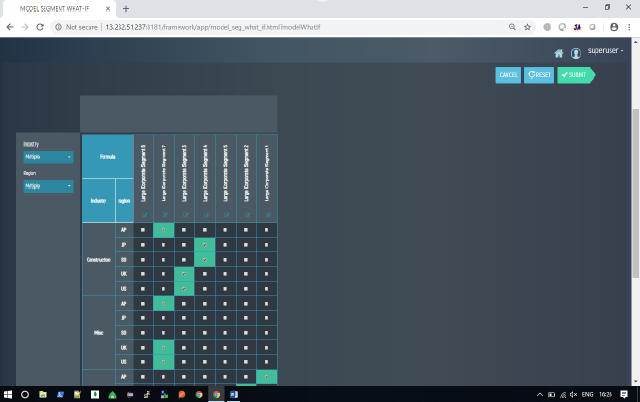

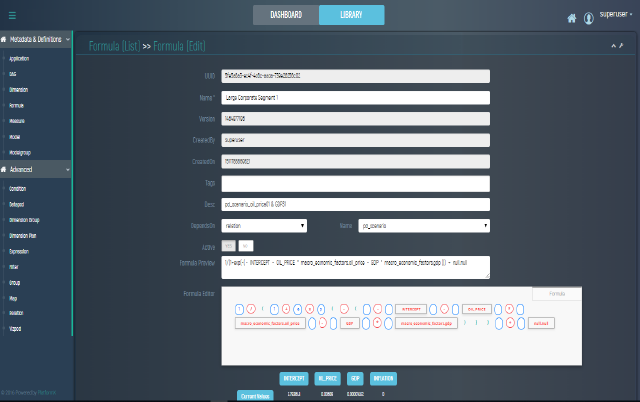

Provides for configuring calculation logic right from business line to product level, along with an exhaustive set of attributes, pre-mapped to required products and/or business lines.

Collateral

Allocation

Control over the limit and collateral allocation module via business rules, and/or other optimization routines. Allocation ability at customer as well as facility level.

Data

Management

Data integration facilitating transaction data loading from multiple sources. Configure data quality identification rules to fix data issues before computation steps.

GL reconciliation feature enables early mitigation of issues if any.

Reporting

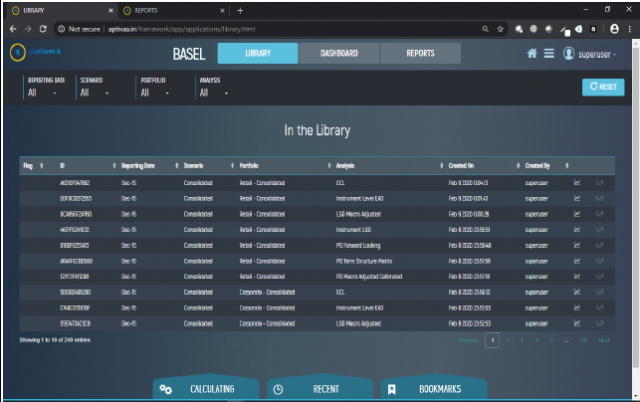

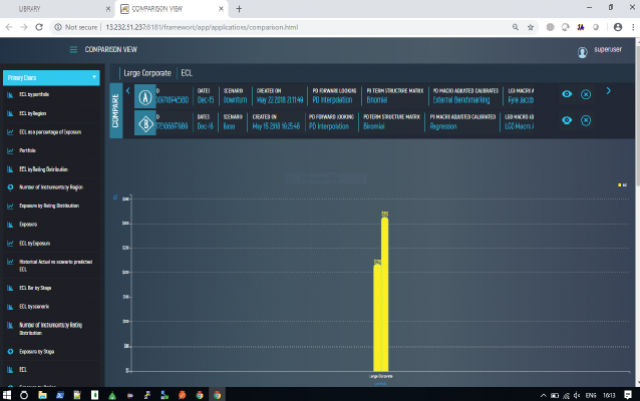

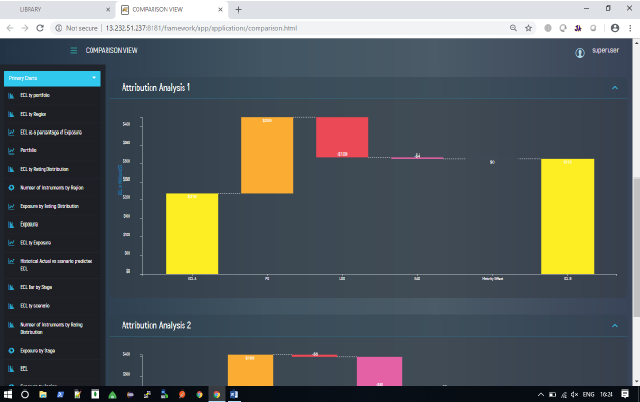

Preconfigured reports as well as deep drill-downs for reconciliation. Local regulatory reports supported for out of the box reporting and disclosures, along with a customizable dashboard and MIS for Senior Management.

Adaptability

Meet with national supervisor requirements and forward compliance with constantly evolving requirements like IFRS 9, IRB, Stress testing, BCBS239.

Consolidate the calculation requirements at group/sub-consolidated level/ jurisdiction.

Perform future proof RWA computations through our AMC support for any changes in Capital Adequacy directives.