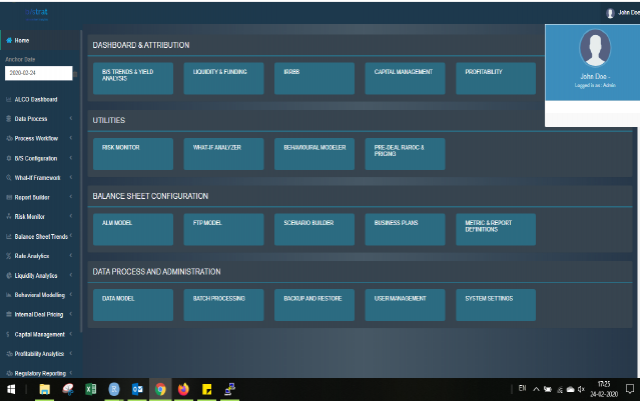

What is Platform X - Balance Sheet Analytics?

Comprehensive coverage of balance sheet risks, inbuilt integrated balance sheet model to enable forward looking analysis and stress testing, attribution of movementsand flexibly to test out new balance sheet strategies.

Attribution

Understand movements in various risk and return metrics in terms of underlying products and individual transactions.

Smart Narrative

and Reporting

Automation of regulatory reporting; Management reporting and dashboards with charts and smart commentary.

Dynamic

Modeling

Dynamic and forward looking approach to forecast risk and return metrics incorporating business plans.

Behavioural Model

Automation

Auto-generate model configuration parameters on a regular basis for behavioural and new business profiles.

What-If/ Integrated

Stress Testing

Bring all risk and return metrics of the balance sheet under a single analytical framework to model response to multiple strategies and scenarios.

Comprehensive Risk

Monitoring

Automated daily tracking of various metrics against risk appetite, early warning indicators with the ability to set-up triggers with notifications.

ALM & FTP

Engine

Driven by an effective ALM & FTP engine that computes deal level cash flows and transfer rate assignment.

Data

Model

Data Dictionary, GL Reconciliation & Balancing, Logical Validation & Corrections.