DigiNext is a next-generation lending solution that powers truly paperless and physical presence-less banking. DigitNext includes digital solutions for Corporate and Retail lending, powered by Deep Learning and other ML algorithms; enabling banks to streamline the lending workflow, reduce turn around time, improve business volumes and Return on Assets.

.png)

Web application with modules for Lead Management and Market Scoping, Client Digital OnBoarding, Automated Data Flow and Authentication, Automated Financial Spreading, Transaction Flow Management, and Portfolio ...

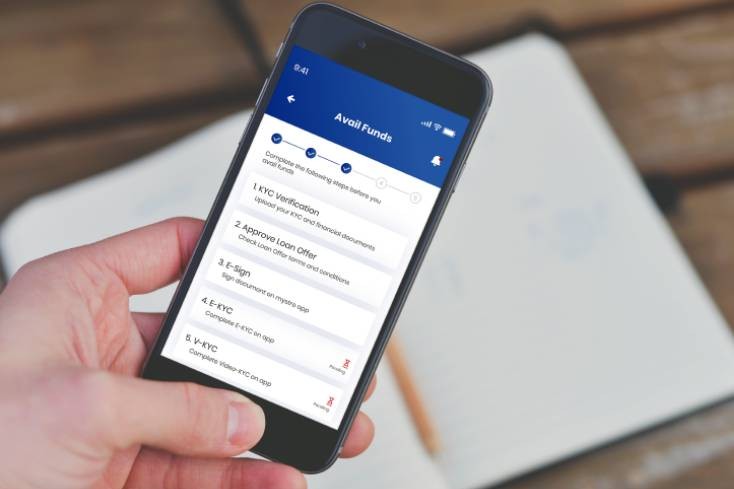

App and suite of pay-per-use APIs for powering journey of retail transactions covering Customer Digital Onboarding, Digital KYC and Fraud Detection, Credit Scoring, Credit Decisioning and Sanction, Documentation and Disbursement...

Web application with modules for Lead Management and Market Scoping, Client Digital On Boarding, Automated Data Flow and Authentication, Automated Financial Spreading, Transaction Flow Management, and Portfolio Monitoring & Management. The solution covers both Corporate and SME portfolios and is fully customizable as per corporate credit workflow of the client institution.

Financial Spreading App and API automates the process of financial spreading and analysis of non-retail entities using advanced text recognition and NLP algorithms. Customer provides either a digital copy, scan copy or image of its financials. Financial Spreading App then digitizes the financials and maps disparate line items to standardized spreading format of the bank for use by downstream applications such as Rating Tool.

A solution to empower domain and business experts in banks/fintechs to use AI-ML for creating business values. The technology has proven impact in areas such as credit scoring, target marketing (cross-sell / up-sell), fraud prevention, collections and channel analytics etc. CreditNext smartly makes all technical decisions for you.

App and suite of pay-per-use APIs for powering journey of retail transactions covering Customer Digital Onboarding, Digital KYC and Fraud Detection, Credit Scoring, Credit Decisioning and Sanction, Documentation and Disbursement.

A solution to empower domain and business experts in banks/fintechs to use AI-ML for creating business values. The technology has proven impact in areas such as credit scoring, target marketing (cross-sell / up-sell), fraud prevention, collections and channel analytics etc. CreditNext smartly makes all technical decisions for you.